Building lasting financial security takes more than luck or sudden windfalls. It demands patience, planning, and persistent action. By approaching wealth creation with intention and discipline, you can transform modest resources into substantial assets over years and decades.

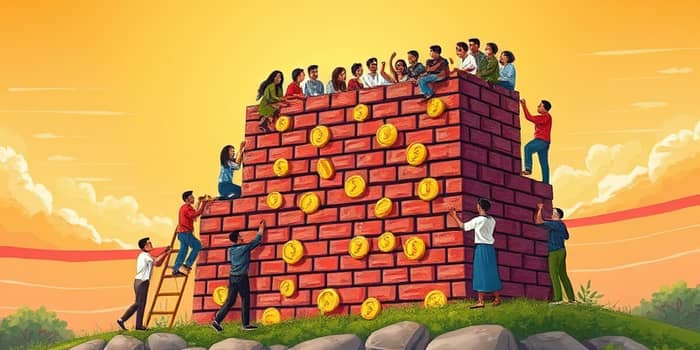

At the heart of every successful wealth journey lies a simple yet profound formula: regular investments and time equals lasting prosperity. This principle reminds us that wealth is rarely the result of overnight success. It grows gradually through steady, intentional moves like budgeting, disciplined saving, and wise investing.

Adopting this mindset means resisting the temptation of quick fixes or high-risk gambles. Instead, you focus on sustainable habits and incremental progress, knowing that compounding rewards favored those who remain in the game for the long haul.

Embarking on any journey without a map can lead to wasted effort. Financial planning demands clarity, which the SMART framework provides. By defining goals that are Specific, Measurable, Achievable, Relevant, and Time-bound, you transform vague aspirations into actionable targets.

A vision-driven approach—linking financial objectives to deeper personal values—can sustain motivation even during market downturns. Knowing why you save and invest provides emotional fuel when challenges arise.

Increasing your income is a cornerstone of wealth creation. Careers in finance, engineering, IT, and management often offer higher earning potential, but growth can come from side ventures, consulting, or entrepreneurship. As earnings rise, it’s crucial to avoid lifestyle inflation and instead redirect raises and bonuses toward growth.

High-interest debt, like credit cards, can erode progress if left unchecked. Prioritize paying off these balances first, then tackle major loans such as mortgages. This disciplined sequence frees up cash flow for investments and prevents unnecessary interest payments.

Before venturing into the market, establish a safety net. An emergency fund with three to six months of living expenses in liquid accounts shields you from unexpected costs and prevents derailing your long-term plan.

For younger savers, high-deductible health plans paired with Health Savings Accounts (HSAs) offer a dual benefit: tax-deductible contributions and tax-free investment growth. Pay medical costs directly from savings to let HSA funds compound uninterrupted.

Regularly audit subscriptions and cash flow using modern apps. Cancel unused services and redirect the savings toward your emergency fund, retirement accounts, or debt repayment. This practice ensures your money works harder for you every month.

Simply saving cannot outpace inflation; investing is essential for real growth. The stock market, with a long-term upward trend, remains an ideal vehicle for accumulating wealth. Early, diversified investing harnesses the power of compounding returns.

Leverage tax-advantaged vehicles like 401(k)s and IRAs while focusing on low-cost index funds. Avoid the noise of daily market fluctuations and remain committed to your strategy through upswings and downturns.

Financial priorities shift as you move through life. Tailor your strategies to each stage to maximize compound growth and minimize risk at the right moments.

Tax-advantaged accounts are more than a bonus—they’re a necessity for maximizing long-term returns. Contribute consistently to tax-deferred and tax-free vehicles, balancing allocations to maintain future flexibility. As you approach retirement, develop withdrawal strategies that minimize tax impact and sustain your lifestyle.

At the core of every successful wealth journey are unwavering habits. Consistent savings, disciplined spending, and continuous education form a virtuous cycle. Seek mentors, join communities, and leverage professional advice to keep your plan on track.

Understand your risk tolerance and adjust asset allocation accordingly. Those with decades ahead can embrace greater equity exposure, while those nearing retirement should prioritize capital preservation.

Building wealth is not a sprint but a marathon. By combining clear goals, disciplined habits, and strategic investments, you lay each brick with intention. Stay patient, trust the process, and maintain a long-term vision and disciplined approach. Over time, small, consistent actions will yield profound results and secure your financial future.

References